Comparative Performance of Gozo Tourism Establishments during the summer period of July to September 2025

During the past weeks, the Gozo Tourism Association carried out an online survey among its members to assess the performance of their establishments during the summer period of 2025, compared to the same months in 2024. Responses were gathered from a broad cross-section of the tourism sector, including accommodation providers, restaurants, diving centres, tourist attractions, transport operators, travel agencies, consultancy firms and other tourism-related businesses.

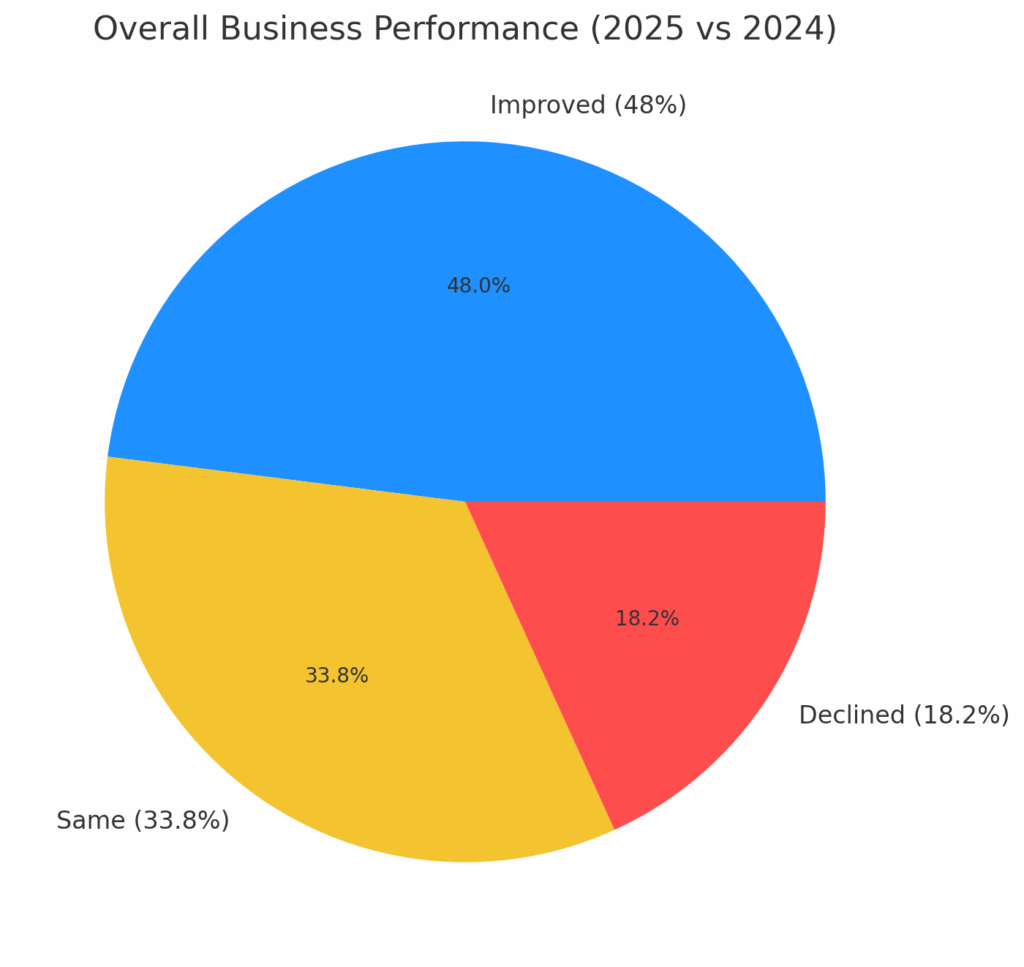

The survey revealed a generally positive outcome for the summer season. When asked to classify their overall business performance for July to September 2025, 48% reported an improvement over 2024, 33.80% stated that performance was on the same level, while 18.20% experienced a decline.

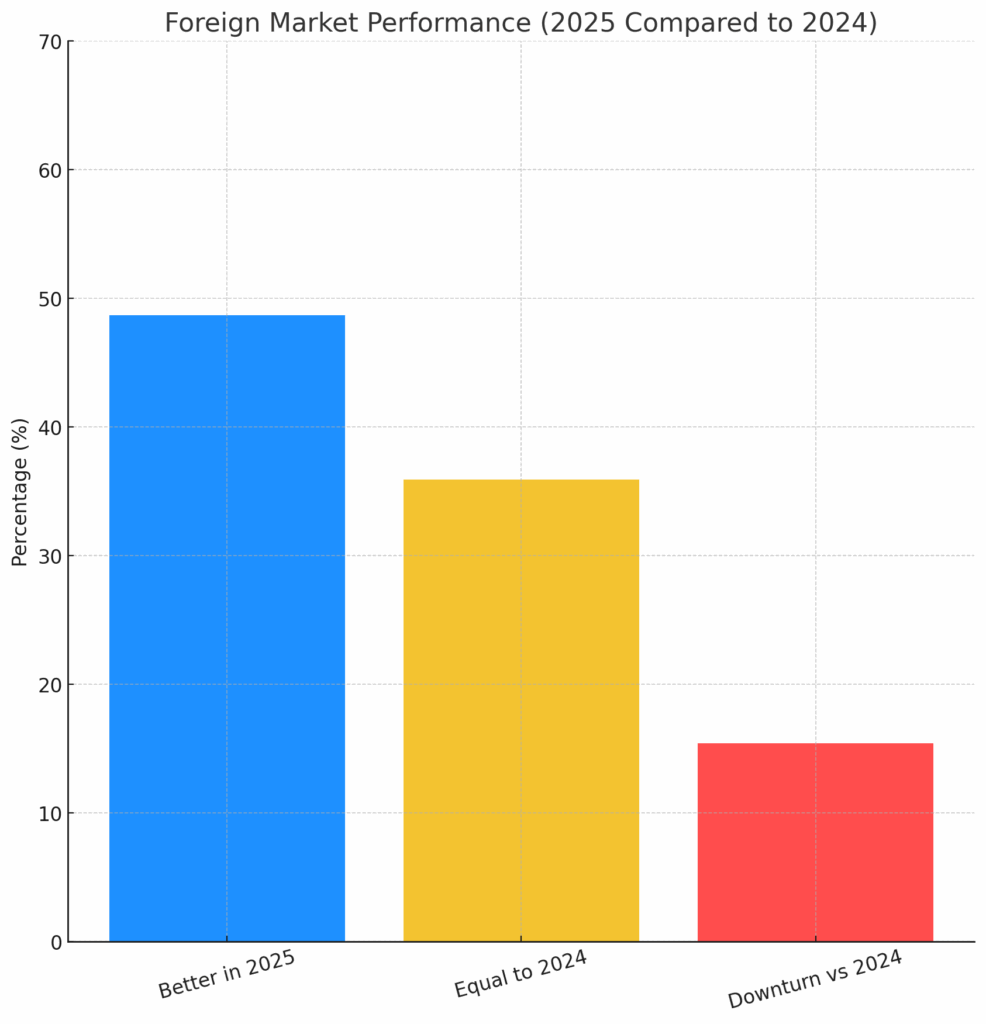

This positive trend was further supported by the impact of the foreign market. 65.40% of respondents reported a positive effect from foreign tourists, with only 11.50% reporting a negative impact. When comparing this year’s foreign market performance with 2024, 48.70% stated it was better, 35.90% said it was equal, and 15.40% experienced a downturn. These findings confirm a strengthening dependence on international visitor flows, which continued to support the sector during peak months.

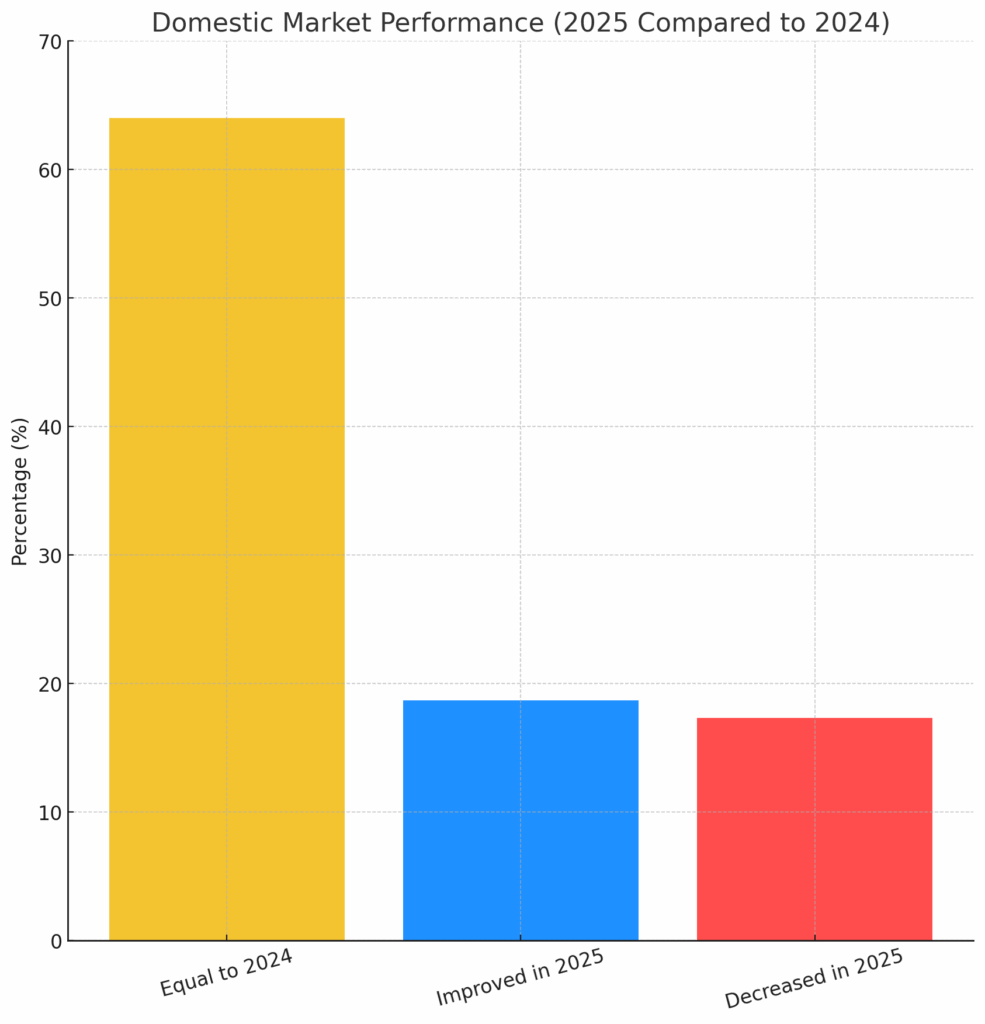

Regarding the domestic market, the results were more stable. A majority, 57%, reported that Maltese tourists had no significant impact on their performance, while 30% experienced a positive effect and 13% a negative one. When compared to 2024, the domestic market remained largely unchanged, with 64% reporting equal performance, 17.30% noting a decrease, and 18.70% observing an improvement.

Revenue levels during summer 2025 were described as strong by most respondents. 61.50%rated their summer revenue as “Good”, while 6.40% classified it as excellent, with only a small minority rating it as poor. When directly compared to summer 2024, the picture remained consistent: 48.70% of operators reported higher revenue, 30.80% stated revenue remained equal, and 20.50% experienced lower figures.

Among those who reported improved revenue, the most frequently cited reasons were increases in their prices (55.50%), an increase in clientele (51%), and more effective marketing strategies (42%). A notable proportion also attributed the improvement to new services or offers (38%), indicating ongoing efforts across the sector to diversify and enhance competitiveness.

When asked about the challenges faced during the summer months, most respondents highlighted familiar obstacles. Rising operating costs remained the most pressing issue, cited by 63.30% of operators, followed by staff shortages (53%). Administrative bureaucracy was highlighted by 26.60%, while 20.30% pointed to the Skills Pass, and 29% noted growing competition. Only 9% reported facing no challenges at all, underscoring a season that continued to test operational resilience.

In terms of business operations, the majority of respondents, 59.50% reported that their operations remained unchanged compared to 2024. Meanwhile, 38% observed an improvement, and only 2.50% reported a deterioration, signalling a largely steady operational environment with pockets of progress. Finally, participants were asked to provide their views on “quality tourism.” When considering the demand side, the type of tourists Gozo is attracting, 74% believed that Gozo is not currently attracting high-quality tourists, with only 26% responding positively. On the supply side, when evaluating whether Gozo offers a quality tourism product in return, 63% felt that the island is not yet providing a sufficiently strong or high-value product, while 37% believed it does. These responses point to a perceived gap between the tourism product offered on the island and the expectations of higher-spending, quality-driven travellers.